Artificial Intelligence (AI) is changing how we handle money. It's making things faster, safer, and smarter in finance. From managing investments to improving customer service, AI apps are at the forefront of this transformation.

In this blog, we'll explore the top 10 AI apps revolutionizing fintech. These apps help with everything from budgeting and saving to fraud detection and credit scoring.

We'll also provide simple tips on using these powerful tools to make your financial life easier and more secure. Whether you're a tech enthusiast or just looking to improve your finances, this guide is for you.

Top 10 AI Apps Revolutionizing Fintech (and How to Use Them)

Here are the best AI apps for fintech:

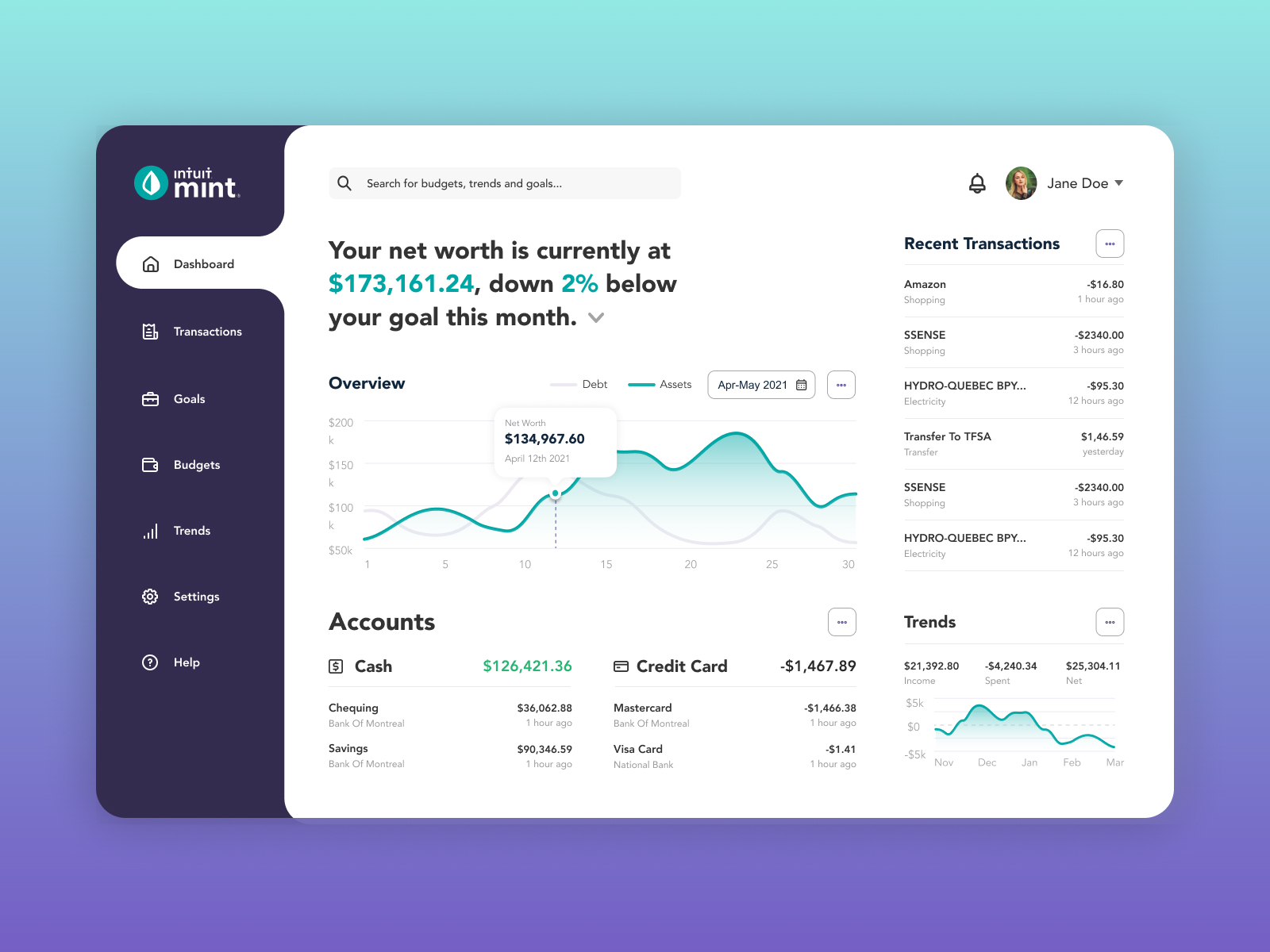

1. Mint: AI-Powered Personal Finance

What It Does:

Mint is an AI-powered financial tool that helps you manage your money by tracking your spending, creating budgets, and providing personalized financial advice. It connects to your bank accounts, credit cards, and bills to give you a complete picture of your finances.

How to Use It:

- Set Up Accounts: Link all your bank accounts, credit cards, and bills to Mint.

- Create Budgets: Use Mint's budgeting tool to set spending limits for different categories like groceries, entertainment, and utilities.

- Track Spending: Monitor your spending habits and get alerts when you're close to your budget limits.

- Receive Advice: Follow Mint's personalized tips to save money and reduce debt.

Read: Best AI Tools For Startups

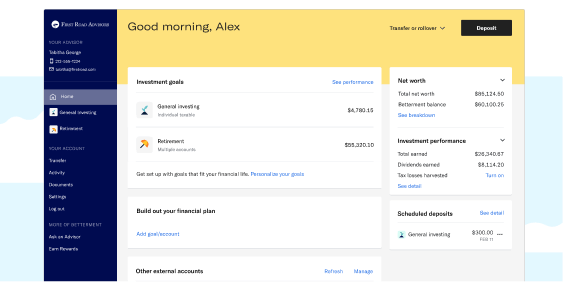

2. Betterment: AI-Enhanced Investment Management

What It Does:

Betterment is an AI-enhanced investment platform that provides automated investment management. It uses AI to create a personalized investment portfolio based on your financial goals and risk tolerance.

How to Use It:

- Sign Up: Create an account and answer questions about your financial goals and risk tolerance.

- Invest Funds: Deposit money into your Betterment account.

- Monitor Performance: Use the Betterment app to track the performance of your investments.

- Adjust Goals: Update your goals and risk tolerance as needed, and Betterment will adjust your portfolio accordingly.

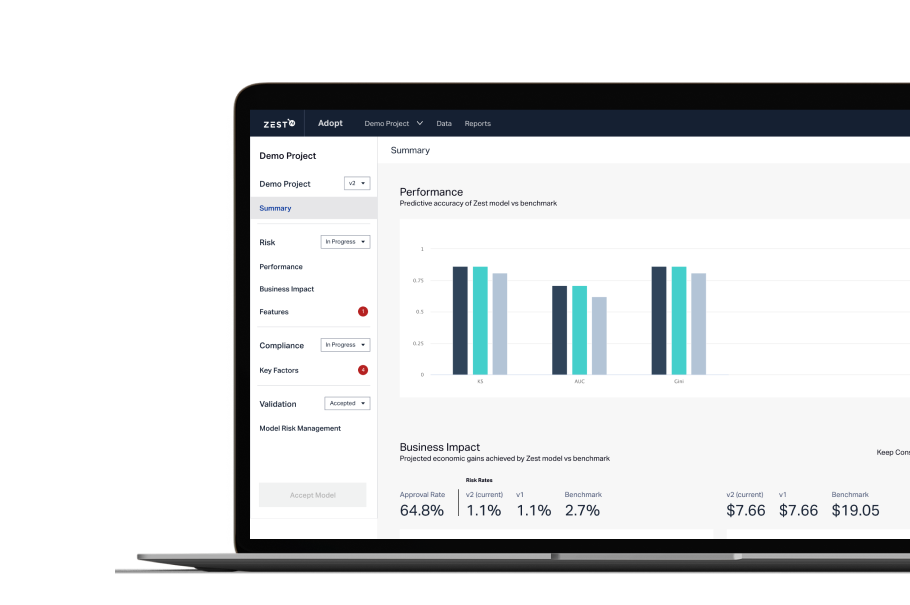

3. ZestFinance: AI for Credit Scoring

What It Does:

ZestFinance uses AI to improve credit scoring. It analyzes non-traditional data, such as payment history and online behavior, to provide more accurate credit scores, especially for those with limited credit history.

How to Use It:

- Apply for Credit: When applying for a loan or credit card, check if the lender uses ZestFinance.

- Improve Score: Follow recommendations to improve your credit score, such as paying bills on time and reducing debt.

- Monitor Changes: Keep an eye on your credit score and see how your actions impact it.

4. Kabbage: AI-Driven Business Loans

What It Does:

Kabbage offers AI-driven business loans by analyzing real-time business data. It provides quick funding for small businesses by evaluating cash flow and other financial metrics.

How to Use It:

- Create an Account: Sign up for a Kabbage account and link your business accounts.

- Apply for a Loan: Complete the loan application by providing necessary business information.

- Receive Funds: Get a loan decision quickly and access funds if approved.

- Manage Loans: Use the Kabbage app to track loan payments and manage your business finances.

Read: Top AI Apps 2024

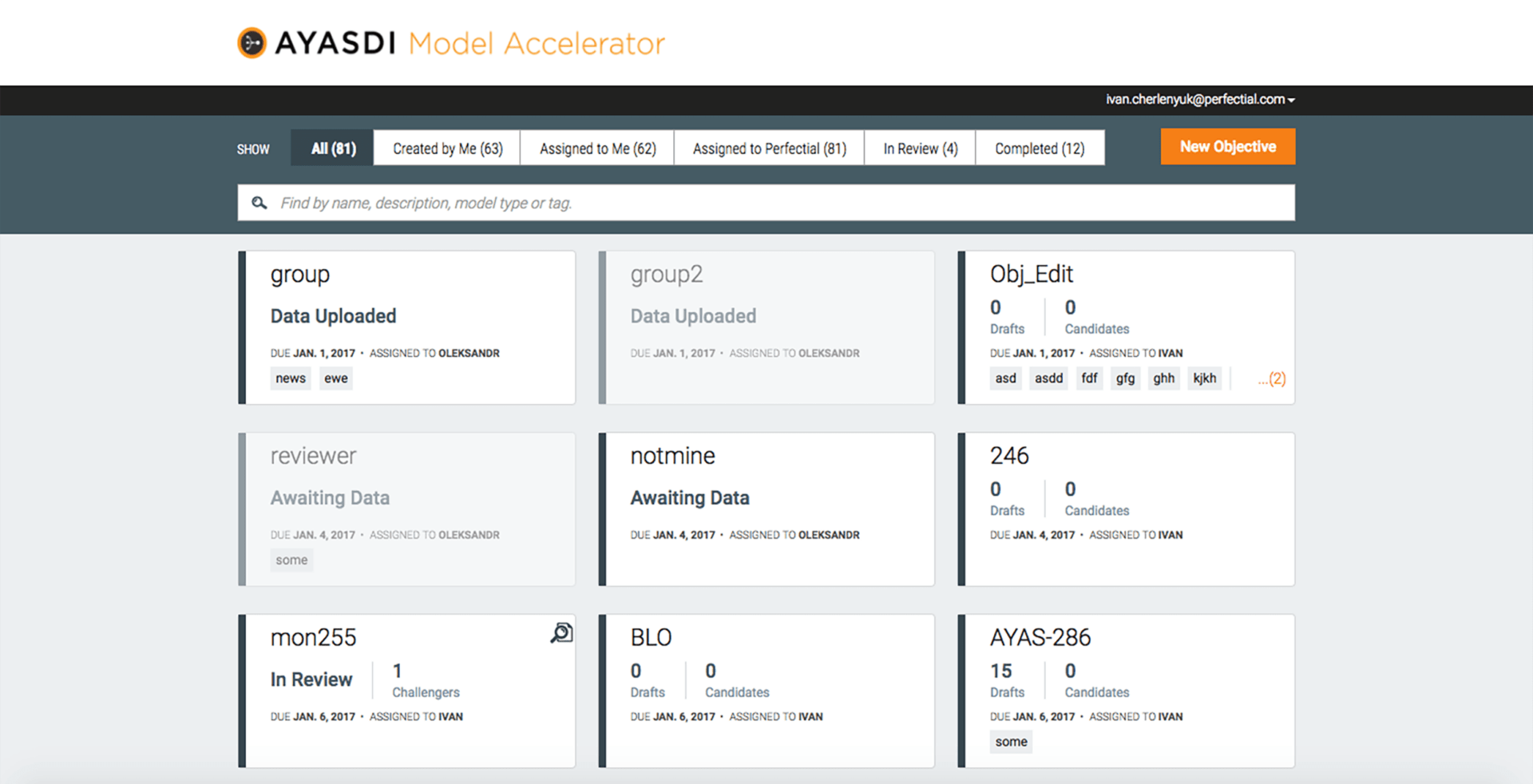

5. Ayasdi: AI Solutions for Financial Services

What It Does:

Ayasdi offers AI solutions for financial services. It uses machine learning to detect patterns and anomalies in financial data, helping banks and financial institutions with tasks like fraud detection and compliance.

How to Use It:

- Implement Ayasdi: Financial institutions need to integrate Ayasdi into their existing systems.

- Analyze Data: Use Ayasdi's tools to analyze large financial data sets for unusual patterns.

- Detect Fraud: Set up alerts for potential fraudulent activity.

- Ensure Compliance: Use Ayasdi to ensure compliance with financial regulations by identifying risky behaviors.

6. Kensho: AI-Powered Financial Analytics

What It Does:

Kensho provides AI-powered financial analytics. It uses natural language processing and machine learning to analyze financial data and provide insights on market trends, economic events, and investment opportunities.

How to Use It:

- Access Kensho: Sign up for Kensho's services through their website or a partner financial institution.

- Explore Data: Use Kensho's tools to explore and analyze financial data.

- Generate Insights: Get insights on market trends and investment opportunities based on Kensho's analysis.

- Make Decisions: Use the insights provided by Kensho to inform your investment decisions.

7. Upstart: AI for Loans

What It Does:

Upstart leverages AI to provide personal loans with a focus on non-traditional credit factors like education and employment history.

How to Use:

- Apply Online: Complete a loan application on Upstart’s website.

- Receive Offers: Get personalized loan offers based on your profile.

- Choose Terms: Select loan terms that suit your financial needs.

- Manage Repayments: Use the Upstart dashboard to keep track of your loan status and payments.

Read: How To Use Midjourney Effectively

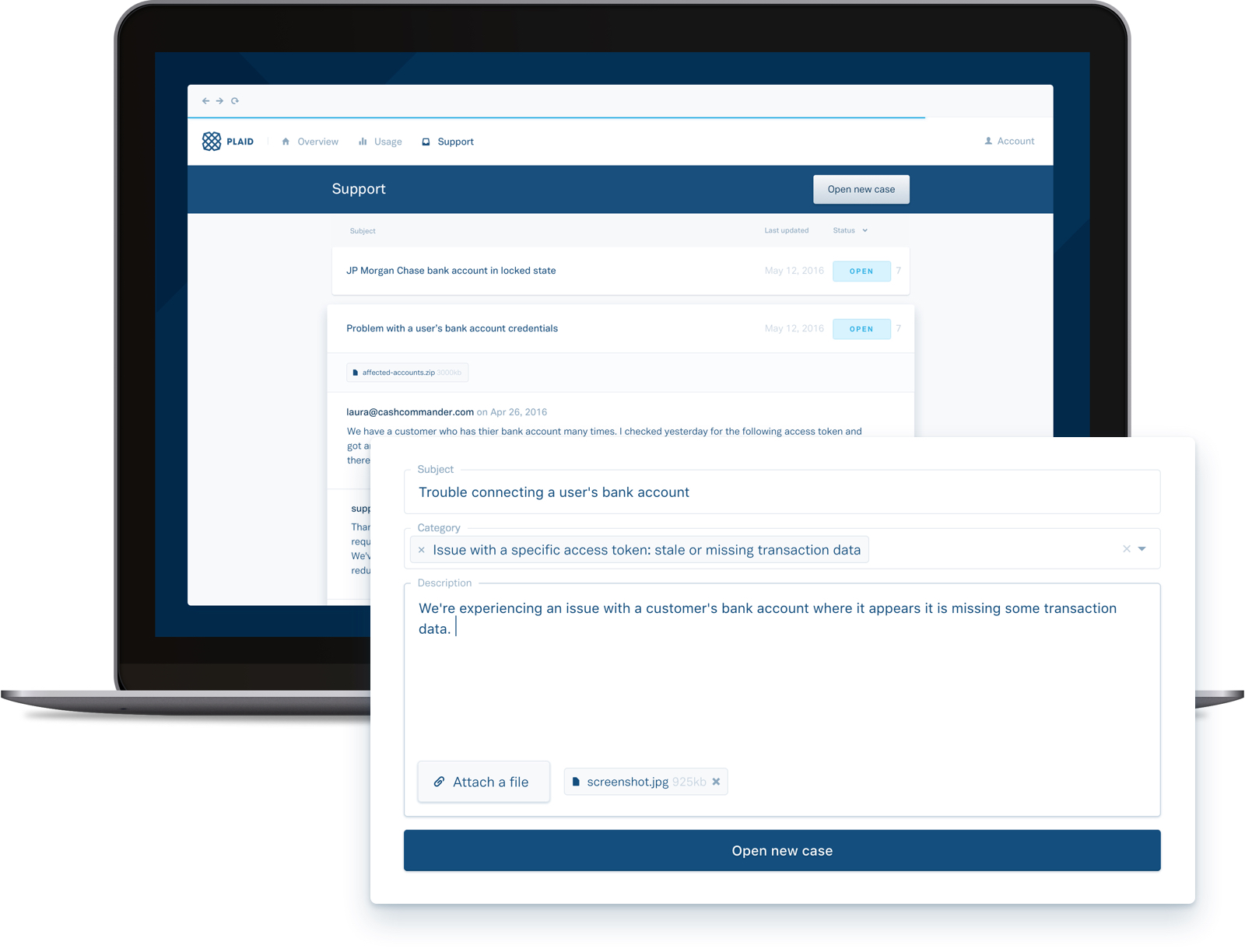

8. Plaid: AI-Enhanced Financial Connectivity

What It Does:

Plaid offers AI-enhanced financial connectivity by providing secure connections between financial apps and user bank accounts. It allows for seamless transactions and data sharing.

How to Use It:

- Connect Accounts: When using a financial app that supports Plaid, connect your bank accounts securely through Plaid.

- Authorize Access: Grant permission for the app to access your financial data.

- Use Financial Apps: Enjoy the benefits of seamless transactions and data sharing between your bank and financial apps.

- Ensure Security: Regularly review and manage your permissions to different apps.

https://plaid.com/blog/machine-learning-income-verification/

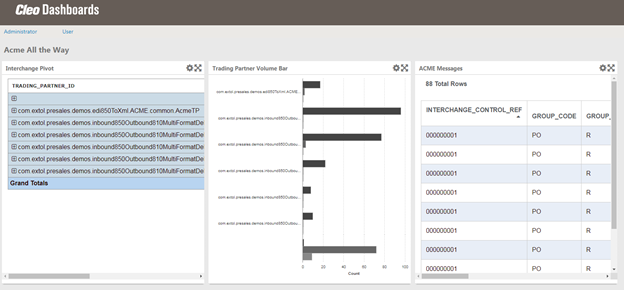

9. Cleo: AI-Driven Financial Assistant

What It Does:

Cleo is an AI-driven financial assistant that helps you manage your money through a chatbot interface. It provides insights into your spending, helps you set budgets, and gives financial advice.

How to Use It:

- Sign Up: Create an account and link your bank accounts to Cleo.

- Chat with Cleo: Use the chatbot to ask questions about your finances and get instant answers.

- Set Budgets: Set up spending limits and track your progress with Cleo's help.

- Receive Advice: Get personalized financial advice and tips to improve your money management.

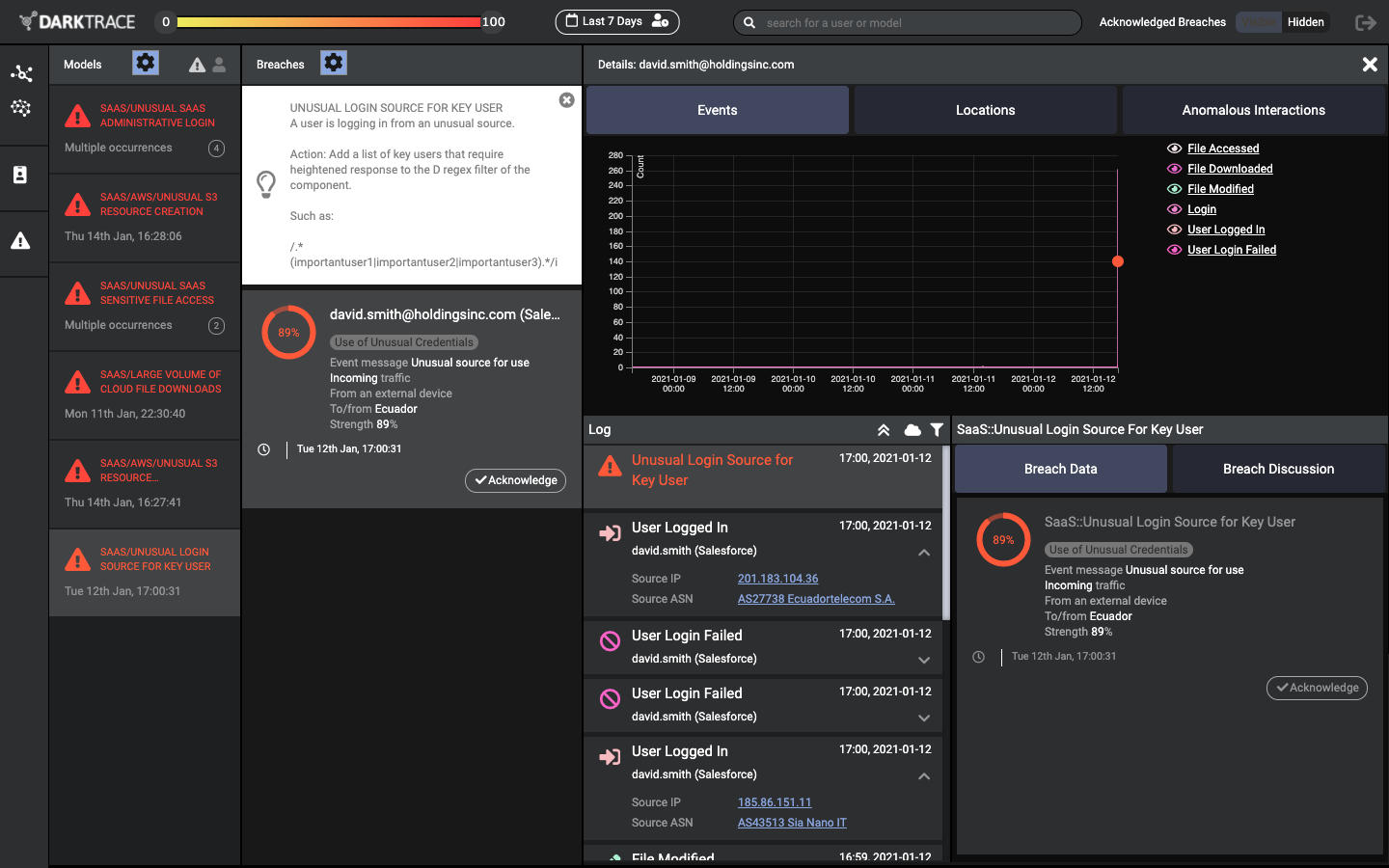

10. Darktrace: AI for Cybersecurity in Finance

What It Does:

Darktrace uses AI to provide cybersecurity solutions for financial institutions. It detects and responds to cyber threats in real time, protecting sensitive financial data.

How to Use It:

- Implement Darktrace: Financial institutions need to integrate Darktrace into their cybersecurity infrastructure.

- Monitor Activity: Use Darktrace to continuously monitor network activity for unusual behavior.

- Detect Threats: Set up alerts for potential cyber threats and breaches.

- Respond to Incidents: Use Darktrace's AI-driven response tools to mitigate and resolve security incidents promptly.

Conclusion

The integration of AI in fintech is revolutionizing the financial landscape, offering smarter, faster, and more secure ways to manage money.

From personal finance tools like Mint and Trim to investment platforms like Betterment and business solutions like Kabbage, these AI-powered financial tools provide unparalleled convenience and efficiency.

By leveraging these innovative AI applications, you can enhance your financial decision-making, safeguard your assets, and achieve your financial goals more easily. Embrace these top fintech apps leveraging AI to stay ahead in the ever-evolving world of finance and secure a brighter financial future.